Circularity 23 Second Day Digest: ‘Funding the Future: Unlocking Circular Investments’

Article subtitle

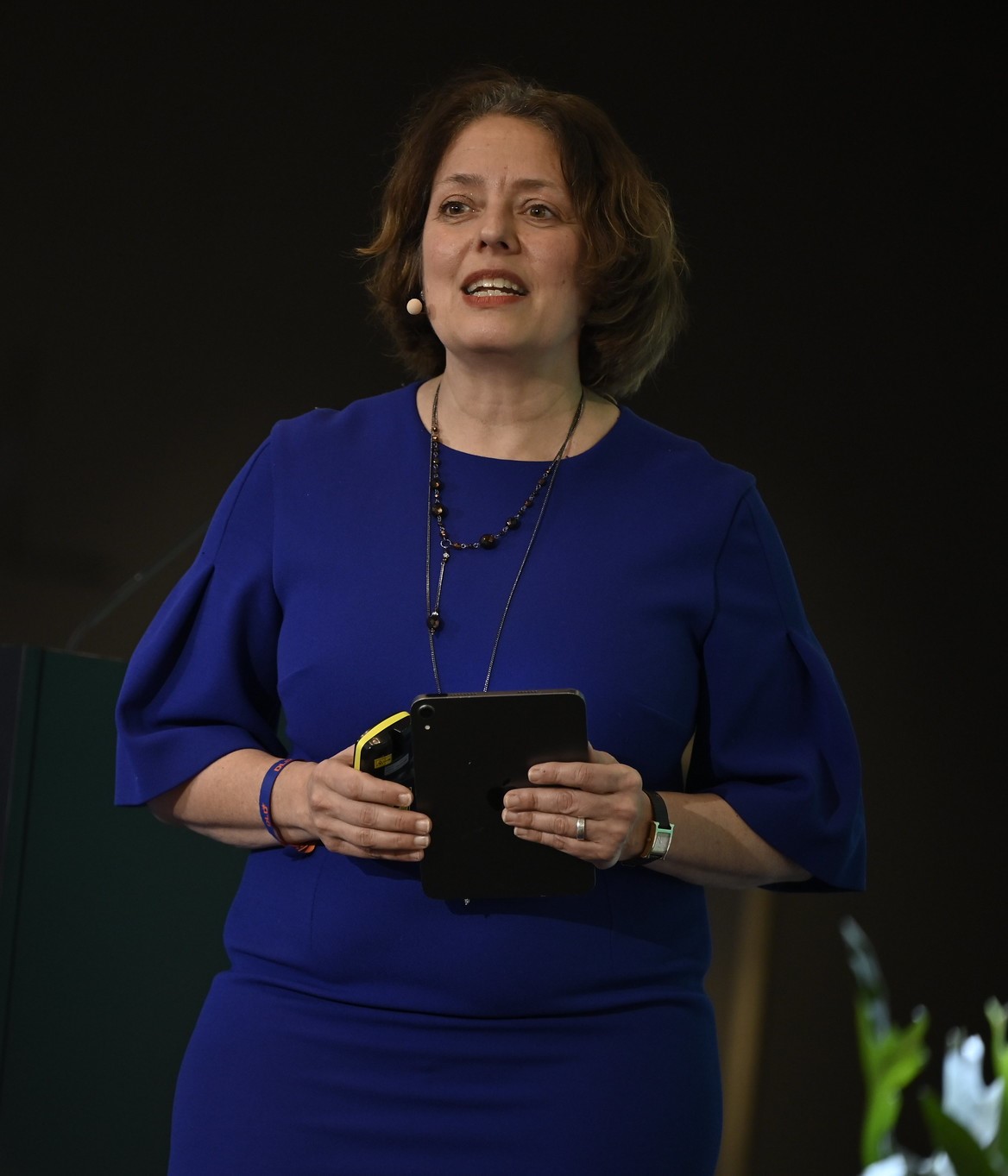

The second day of Circularity 23 began with a dynamic panel discussion moderated by PACE Executive Director, Ramona Liberoff.

The second day of Circularity 23 began with a dynamic panel discussion moderated by PACE Executive Director, Ramona Liberoff.

Participants: Ramona Liberoff (Executive Director, PACE), Aly Bryan (Investor, Ventures Group Closed Loop Partners), Eva Gladek (Founder and CEO, Metabolic), and Michael Smith (General Partner, Regeneration. VC)

___________________________________________________________

The second day of Circularity 23 began with a dynamic panel discussion moderated by PACE Executive Director, Ramona Liberoff. Panelists explored themes that ignited the discourse surrounding the urgent need to rethink conventional funding mechanisms to advance the circular transition. The lively conversation highlighted key differences between North American and European funding models for the circular economy and shed light on the following main points:

European Public-Private Funding and Place-Based Interventions

European funding models were characterized by strong public-private partnerships and a focus on place-based interventions. Prominent examples, such as De Ceuvel in Amsterdam and the work carried out by Metabolic, demonstrated successful collaborations between public entities and private stakeholders. These initiatives showcased the potential for localized circular interventions driven by collective efforts and multi-stakeholder partnerships.

US Public Funding as One-Time Input and Scalable Profitable Models

Contrasting the European approach, the panel discussion noted that US public funding for circular economy initiatives often viewed financial support as a one-time input. Rather than fostering sustained partnerships, the focus tended to be on short-term projects. The need for scalable and profitable models was emphasized, highlighting the importance of building circular infrastructure that can generate long-term economic and environmental benefits.

Insufficient Capital Allocation for Circular Economy Infrastructure

A significant concern raised during the discussion was the inadequacy of capital directed toward building the infrastructure required for a circular economy. Despite the growing recognition of circularity as a transformative concept, financial investment in the necessary physical and logistical aspects remained limited. The panel underscored the importance of attracting more capital to support the development and scaling of circular infrastructure.

Limited Understanding and Specialized Investment Funds

The panel discussion highlighted the scarcity of investors who possess a comprehensive understanding of the link between circular economy initiatives and their broader impact. While the interest in impact investing has been growing, there are still relatively few specialist funds dedicated to circular economy projects. This knowledge gap creates a barrier to financing circular initiatives and indicates the need for increased awareness and specialized investment vehicles.

Inclusive Q&A Session Reflecting High Engagement

Following the panel discussion, an inclusive and engaging question-and-answer session took place, with nearly 200 participants contributing their inquiries. This active participation demonstrated a keen interest and enthusiasm surrounding the topic of funding models for the circular economy.

The insights gained from the discussion and Q&A session serve as a valuable resource for partners and followers of the conference. By examining the differences between North American and European funding models, recognizing the importance of adequate capital allocation, and addressing the limited understanding among investors, stakeholders can identify opportunities to drive financial support and accelerate the transition towards a thriving circular economy.